CBAM Explained Simply: What EU Importers and Exporters Need to Do Now

CBAM Explained Simply: What EU Importers and Exporters Need to Do Now

CBAM has been discussed in policy circles for years, but for many exporters it still feels distant or abstract. That perception is changing quickly. Since the start of the transitional phase, EU importers are already required to submit CBAM reports, and those reports depend heavily on data provided by non-EU suppliers.

For exporters supplying the EU, CBAM is no longer something to “watch closely.” It is something that now affects how production emissions are calculated, documented, and shared with customers.

This article explains what CBAM really requires, where companies are struggling, and what practical steps exporters should focus on right now.

Why CBAM Exists in the First Place

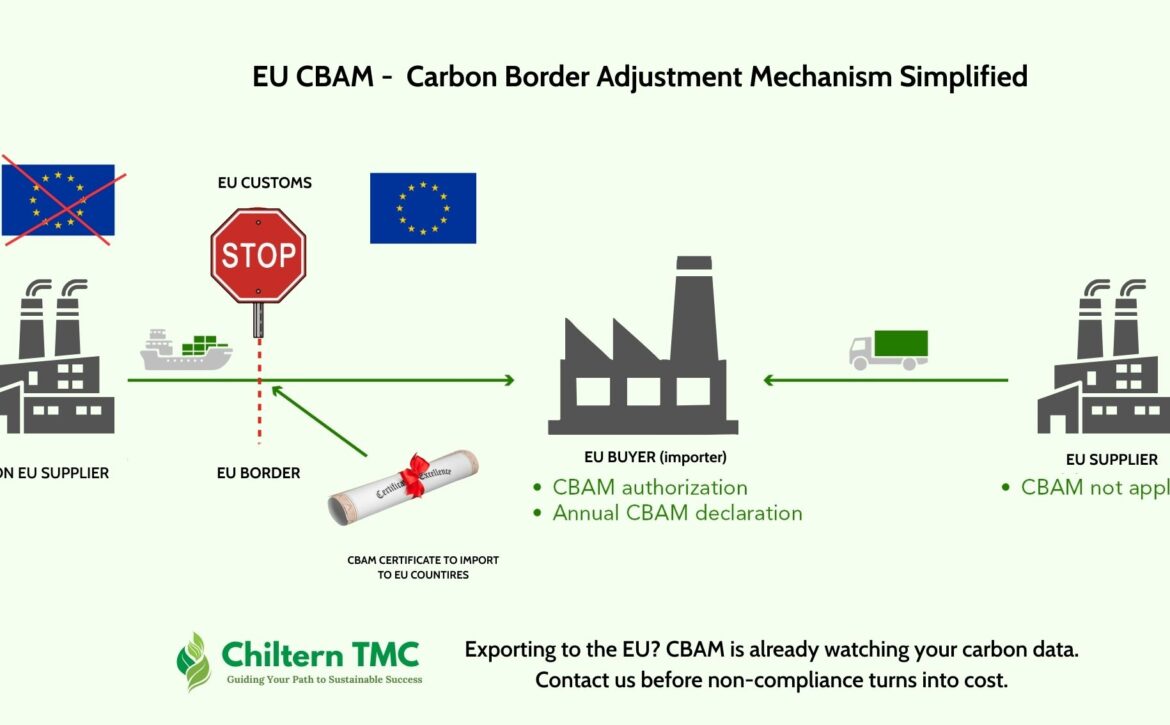

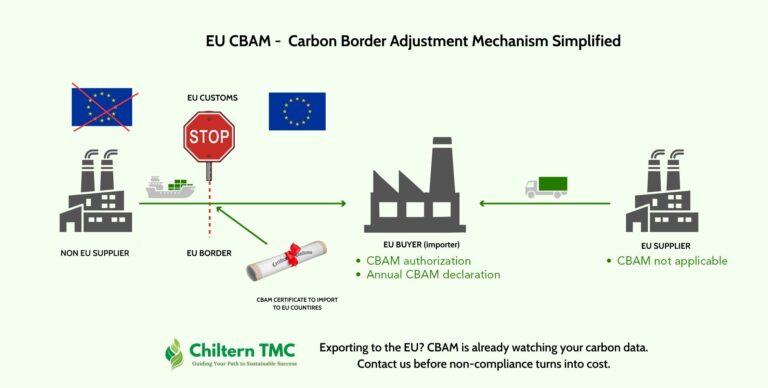

CBAM was introduced as part of the EU’s broader climate framework to address carbon leakage. In simple terms, the EU wants to avoid a situation where domestic manufacturers reduce emissions and absorb carbon costs, while imported products with higher emissions enter the market without similar constraints.

Instead of relying only on tariffs or trade barriers, CBAM ties market access to emissions transparency. Products entering the EU must now be accompanied by data showing how carbon-intensive their production was.

This marks a shift. Carbon data is no longer limited to sustainability reports or voluntary disclosures. It is becoming a regulatory requirement linked directly to trade.

What CBAM Actually Requires

During the current transitional phase, CBAM focuses on reporting, not payments. EU importers must submit quarterly reports detailing the greenhouse gas emissions embedded in specific imported goods.

Although the legal obligation sits with the importer, exporters play a critical role. Without reliable emissions data from manufacturers, importers are forced to rely on default values, which are often conservative and can work against both parties.

The transitional phase is effectively a test period, but the data collected now will influence how future financial obligations are calculated once CBAM moves into its definitive phase.

Which Companies Are Affected

CBAM currently applies to imports of:

- Cement

- Iron and steel

- Aluminium

- Fertilisers

- Hydrogen

- Electricity

If you manufacture or export products in these categories to the EU, CBAM already applies to your supply chain, even if no carbon payments are due yet.

It is also important to note that CBAM coverage is expected to expand. Companies outside the current scope are still watching closely, as similar reporting expectations may apply to additional sectors in the coming years.

Understanding Embedded Emissions Without the Jargon

One of the most confusing aspects of CBAM is the term “embedded emissions.”

In practice, embedded emissions are the greenhouse gases released during the production of a product, up to the point it is imported into the EU. Under CBAM, this mainly includes:

- Direct emissions from manufacturing processes

- Indirect emissions from electricity used in production

This is not a high-level estimate. It requires clear boundaries, defined methodologies, and supporting documentation. Companies that already track emissions for internal or reporting purposes often find that CBAM requires a higher level of detail and structure.

What the Transitional Phase Is Really About

The transitional phase is often described as a “learning period,” but that can be misleading. While penalties are limited at this stage, inaccurate or poorly documented data can still create problems with EU customers.

From what we are seeing across exporters, the transitional phase is where most of the groundwork must be done:

- Establishing emissions calculation methods

- Aligning production data with regulatory definitions

- Creating internal processes for data collection and review

Companies that delay this work often end up reacting to importer requests under tight deadlines.

Common Challenges Exporters Are Facing

Several issues come up repeatedly when exporters begin preparing CBAM data:

- Emissions calculations are based on estimates rather than measured data

- Production boundaries are unclear or inconsistently defined

- Assumptions are not documented properly

- CBAM data does not align with corporate GHG inventories

- Sustainability teams are disconnected from production and finance teams

These challenges are not unusual. CBAM sits at the intersection of sustainability, operations, and compliance, which means it requires coordination across functions that do not always work closely together.

How CBAM Connects to ISO 14064 and Verification

Exporters with ISO 14064–aligned greenhouse gas inventories generally find CBAM easier to manage. The reason is straightforward. ISO-aligned systems already require defined boundaries, consistent methodologies, and traceable records.

While CBAM reporting itself is not the same as ISO verification, the underlying discipline is similar. Independent verification can also help strengthen confidence in the data being shared with EU importers, particularly as scrutiny increases over time.

For companies supplying large EU customers, credible and well-documented emissions data is becoming a commercial expectation, not just a regulatory one.

Practical Steps to Focus on Now

Rather than treating CBAM as a reporting task, exporters should approach it as a data governance exercise.

In practical terms, this means:

- Confirming whether products fall under CBAM scope

- Reviewing how emissions are currently calculated and documented

- Identifying data gaps early, especially around electricity use

- Aligning CBAM data with existing GHG inventories

- Preparing for future verification requirements

These steps are far easier to manage when taken proactively, rather than in response to last-minute requests from importers.

CBAM as a Signal, Not Just a Regulation

CBAM is often discussed as a standalone regulation, but it signals a broader trend. Carbon transparency is becoming embedded in trade rules, procurement decisions, and supplier evaluations.

For exporters, this changes the role of sustainability data. It is no longer just about reporting performance. It directly affects market access, competitiveness, and long-term relationships with EU customers.

Companies that invest time now in getting their emissions data right will be better positioned not only for CBAM, but for the wider set of climate-related trade measures that are likely to follow.

Written by Ahamed Aasir, Sustainability Marketing Consultant for Chiltern TMC Consultant.

Last Updated: Jan 07, 2025