The Importance of ESG Due Diligence in Corporate Decision-Making

The Importance of ESG Due Diligence in Corporate Decision-Making – ESG Reporting

The Importance of ESG Due Diligence in Corporate Decision-Making – ESG Reporting

Businesses often want to verify whether a sustainability or EcoVadis consulting company is officially recognized by EcoVadis. The EcoVadis Partner Directory is the correct place to do this.

This guide explains, step by step, how to navigate the EcoVadis website and find Chiltern TMC listed as a consulting partner.

Start by visiting the official EcoVadis Partner Directory page using the link below:

https://ecovadis.com/partnerships/#partner-directory

This page lists all approved EcoVadis partners worldwide and allows users to filter partners by service type and region.

Once the page loads, you will see filtering options on the partner directory.

Under Partner Type:

–> Select Consulting

This filter ensures that only consulting partners, and not technology or training providers, are displayed.

Within the consulting filter:

–> Select Core

Core consulting partners are those actively supporting companies with EcoVadis assessments, scorecard improvement, and sustainability performance enhancement.

Next, apply the regional filter:

–> Go to Region

–> Select Europe, Middle East and Africa

This narrows the results to partners operating across EMEA regions.

After applying all filters:

Scroll through the results

You will find Chiltern TMC listed with its official logo and partner information

This confirms that Chiltern TMC is an approved EcoVadis consulting partner for the selected regions.

EcoVadis is a globally trusted sustainability ratings provider used by thousands of organizations to assess environmental, social, and ethical performance across supply chains.

Chiltern TMC is Accredited as a consulting partner on the EcoVadis Partner Directory, supporting organizations across Europe, the Middle East, and Africa with EcoVadis-related consulting and sustainability improvement initiatives.

Written by Ahamed Aasir, Sustainability Marketing Consultant for Chiltern TMC Consultant.

Last Updated: Jan 22, 2025

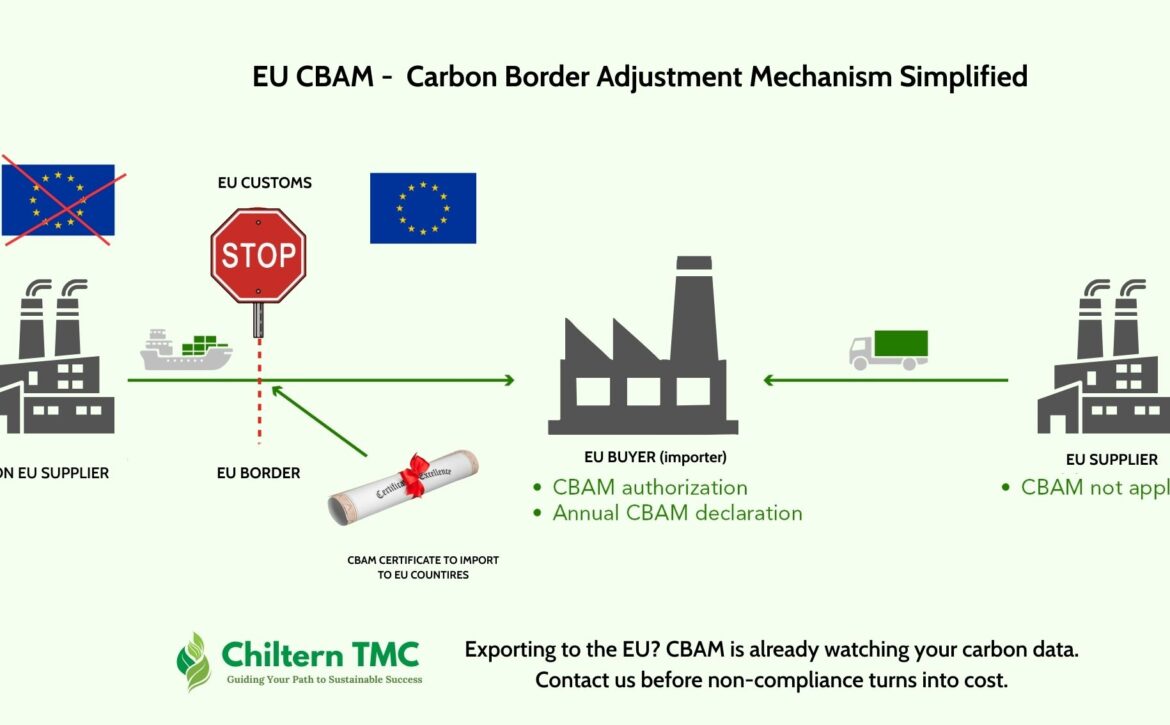

CBAM has been discussed in policy circles for years, but for many exporters it still feels distant or abstract. That perception is changing quickly. Since the start of the transitional phase, EU importers are already required to submit CBAM reports, and those reports depend heavily on data provided by non-EU suppliers.

For exporters supplying the EU, CBAM is no longer something to “watch closely.” It is something that now affects how production emissions are calculated, documented, and shared with customers.

This article explains what CBAM really requires, where companies are struggling, and what practical steps exporters should focus on right now.

CBAM was introduced as part of the EU’s broader climate framework to address carbon leakage. In simple terms, the EU wants to avoid a situation where domestic manufacturers reduce emissions and absorb carbon costs, while imported products with higher emissions enter the market without similar constraints.

Instead of relying only on tariffs or trade barriers, CBAM ties market access to emissions transparency. Products entering the EU must now be accompanied by data showing how carbon-intensive their production was.

This marks a shift. Carbon data is no longer limited to sustainability reports or voluntary disclosures. It is becoming a regulatory requirement linked directly to trade.

During the current transitional phase, CBAM focuses on reporting, not payments. EU importers must submit quarterly reports detailing the greenhouse gas emissions embedded in specific imported goods.

Although the legal obligation sits with the importer, exporters play a critical role. Without reliable emissions data from manufacturers, importers are forced to rely on default values, which are often conservative and can work against both parties.

The transitional phase is effectively a test period, but the data collected now will influence how future financial obligations are calculated once CBAM moves into its definitive phase.

CBAM currently applies to imports of:

If you manufacture or export products in these categories to the EU, CBAM already applies to your supply chain, even if no carbon payments are due yet.

It is also important to note that CBAM coverage is expected to expand. Companies outside the current scope are still watching closely, as similar reporting expectations may apply to additional sectors in the coming years.

One of the most confusing aspects of CBAM is the term “embedded emissions.”

In practice, embedded emissions are the greenhouse gases released during the production of a product, up to the point it is imported into the EU. Under CBAM, this mainly includes:

This is not a high-level estimate. It requires clear boundaries, defined methodologies, and supporting documentation. Companies that already track emissions for internal or reporting purposes often find that CBAM requires a higher level of detail and structure.

The transitional phase is often described as a “learning period,” but that can be misleading. While penalties are limited at this stage, inaccurate or poorly documented data can still create problems with EU customers.

From what we are seeing across exporters, the transitional phase is where most of the groundwork must be done:

Companies that delay this work often end up reacting to importer requests under tight deadlines.

Several issues come up repeatedly when exporters begin preparing CBAM data:

These challenges are not unusual. CBAM sits at the intersection of sustainability, operations, and compliance, which means it requires coordination across functions that do not always work closely together.

Exporters with ISO 14064–aligned greenhouse gas inventories generally find CBAM easier to manage. The reason is straightforward. ISO-aligned systems already require defined boundaries, consistent methodologies, and traceable records.

While CBAM reporting itself is not the same as ISO verification, the underlying discipline is similar. Independent verification can also help strengthen confidence in the data being shared with EU importers, particularly as scrutiny increases over time.

For companies supplying large EU customers, credible and well-documented emissions data is becoming a commercial expectation, not just a regulatory one.

Rather than treating CBAM as a reporting task, exporters should approach it as a data governance exercise.

In practical terms, this means:

CBAM is often discussed as a standalone regulation, but it signals a broader trend. Carbon transparency is becoming embedded in trade rules, procurement decisions, and supplier evaluations.

For exporters, this changes the role of sustainability data. It is no longer just about reporting performance. It directly affects market access, competitiveness, and long-term relationships with EU customers.

Companies that invest time now in getting their emissions data right will be better positioned not only for CBAM, but for the wider set of climate-related trade measures that are likely to follow.

Written by Ahamed Aasir, Sustainability Marketing Consultant for Chiltern TMC Consultant.

Last Updated: Jan 07, 2025

Sustainability has become a key driver of business success across the Middle East and beyond. In regions like Saudi Arabia, where environmental responsibility and ethical supply chains are becoming central to national and corporate agendas, companies are increasingly evaluated not only on their financial performance but also on how responsibly they operate.

Among the many frameworks available, EcoVadis has emerged as a global benchmark for assessing corporate sustainability.

However, the EcoVadis assessment process can be detailed and demanding. Understanding the requirements, preparing evidence, and aligning with international sustainability standards often requires expert guidance. This is where partnering with an experienced EcoVadis consultant can make a measurable difference.

EcoVadis is the world’s most widely used platform for evaluating a company’s environmental, social, and ethical performance. It assesses organizations based on four key pillars:

Environment – energy, emissions, and resource efficiency

Labor & Human Rights – working conditions, diversity, and employee welfare

Ethics – anti-corruption, transparency, and fair practices

Sustainable Procurement – supplier management and responsible sourcing

A strong EcoVadis rating can enhance brand reputation, build trust with clients, and improve supply chain credibility.

In Saudi Arabia and across the GCC, many government projects and private clients now require their suppliers to maintain a verified sustainability rating — making EcoVadis an essential factor in qualifying for new contracts.

Achieving a high EcoVadis score is not just about submitting documents — it’s about demonstrating a company’s genuine commitment to sustainability. An EcoVadis consultant brings both technical expertise and strategic insight to this process.

Consultants begin by reviewing your company’s existing sustainability practices, policies, and certifications. They identify strengths, pinpoint areas for improvement, and guide you through preparing the right documentation for submission. This includes environmental policies, HR procedures, ethical codes, supplier questionnaires, and more.

Beyond compliance, a skilled consultant helps organizations design long-term improvement strategies — aligning sustainability goals with business growth. With their support, companies can confidently approach EcoVadis assessments and build a clear roadmap toward achieving higher ratings, such as Silver, Gold, or Platinum.

Consultants assess where your organization currently stands in comparison to EcoVadis criteria. This helps identify what’s missing and sets clear priorities for improvement before submission.

One of the biggest challenges companies face is preparing the right documentation. Consultants help organize policies, reports, and certifications to ensure that evidence aligns precisely with EcoVadis expectations.

EcoVadis is not just about policies — it values measurable actions. Consultants guide businesses in implementing sustainability programs, defining KPIs, and strengthening supplier evaluations that directly impact scoring.

Navigating the EcoVadis online platform can be tedious. Consultants review every section of your submission, ensuring accuracy, consistency, and completeness.

Once the results are released, consultants help interpret your scorecard and recommend targeted actions to improve in the next assessment cycle. This ensures continuous progress instead of one-time compliance.

A consultant helps avoid trial-and-error during the assessment, saving valuable time and preventing documentation rework.

With hands-on experience in EcoVadis submissions, consultants know which areas carry the most weight and how to optimize each section effectively.

Many companies lose points due to missing, outdated, or irrelevant evidence. Consultants ensure every document submitted supports your score.

A higher EcoVadis rating strengthens brand credibility, supports tender participation, and improves relationships with sustainability-driven clients.

Instead of treating EcoVadis as a checklist, consultants help embed sustainability practices within your operations — ensuring ongoing improvement and compliance.

Chiltern TMC has helped over 30 companies across Dubai, Abu Dhabi, and Saudi Arabia achieve EcoVadis Gold and Platinum ratings through structured consulting, documentation support, and sustainability strategy.

We are also proud to hold EcoVadis Platinum status for our own organization, demonstrating the same level of sustainability excellence we deliver to our clients.

As the only EcoVadis-accredited consulting firm in the Middle East, Chiltern TMC combines deep technical knowledge with regional experience — ensuring every client receives globally recognized results backed by credibility, accuracy, and transparency.

At Chiltern TMC, we help organizations strengthen their sustainability performance and gain recognition through higher EcoVadis ratings.

Our team of consultants has supported companies across Saudi Arabia, the UAE, and Europe — helping them move from Bronze to Gold and Platinum through structured improvement programs.

Our approach includes:

Initial Readiness Assessment – evaluating your current standing against EcoVadis criteria.

Evidence Collection and Review – preparing well-documented, audit-ready submissions.

Score Improvement Planning – implementing strategies to enhance performance across all four EcoVadis pillars.

Guided Submission Support – ensuring accuracy and completeness during portal submission.

Ongoing Advisory – planning for reassessment and continuous improvement.

Our consulting approach has delivered measurable outcomes.

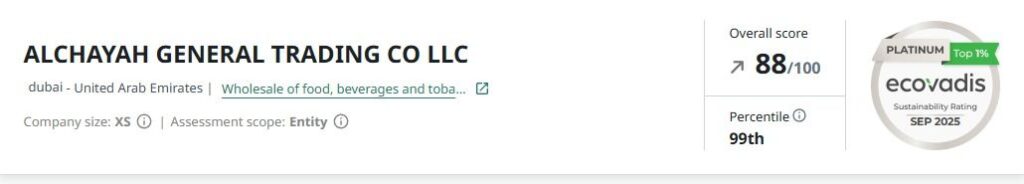

We recently supported Al Chayah General Trading Co. LLC in achieving an EcoVadis Platinum rating, recognizing their strong sustainability management and ethical business practices.

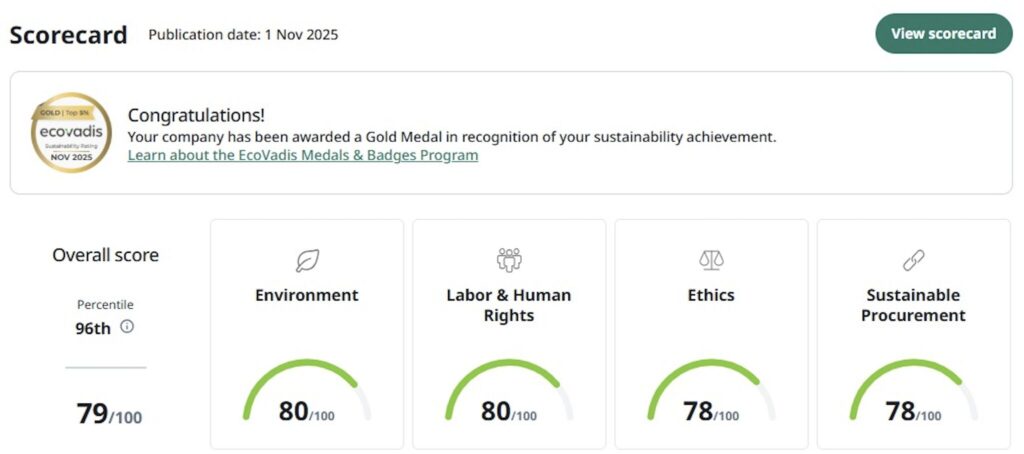

Similarly, Emirates Computers attained an EcoVadis Gold rating through our focused guidance on policy refinement, documentation, and supplier sustainability.

These results reflect Chiltern TMC’s commitment to helping businesses — in Dubai, Saudi Arabia and beyond — strengthen their sustainability performance and gain recognition on the global stage.

As sustainability continues to shape business opportunities in regions like Saudi Arabia, your EcoVadis rating reflects more than compliance — it shows your company’s values and long-term commitment to responsible growth.

Partnering with an experienced EcoVadis consultant ensures that your sustainability journey is strategic, credible, and aligned with global standards.

At Chiltern TMC, we simplify the complexity of EcoVadis assessments and turn them into clear opportunities for improvement, growth, and recognition.

Ready to strengthen your EcoVadis performance in Saudi Arabia or the GCC?

Reach out to Chiltern TMC’s EcoVadis consulting team today to schedule a readiness assessment and discover how we can help your business move from Bronze to Gold — and beyond.

Written by Ahamed Aasir, Sustainability Marketing Consultant for Chiltern TMC Consultant.

Last Updated: November 14, 2025

Every manufacturer pursuing low-carbon projects in 2025 encounters the same requirement on bid forms and specifications: “Provide an EPD Certification.” An Environmental Product Declaration verified to ISO 14025 demonstrates your ability to quantify, reduce, and transparently communicate lifecycle impacts. This comprehensive guide explains how to progress from initial Life Cycle Assessment (LCA) data collection to a published EPD Certification that meets third-party verification standards and satisfies EN 15804+A2 requirements.

EPD Certification delivers three critical advantages:

Industry practitioners and the International EPD® System have established a comprehensive seven-stage process. Mastering each phase reduces lead times, minimizes verifier revisions, and ensures successful EPD Certification.

Gather primary data on raw materials, energy consumption, transportation, and on-site emissions. Supplement with secondary databases like ecoinvent for upstream background processes. Comprehensive data collection at this stage minimizes verifier queries and strengthens the foundation for your EPD Certification.

Utilize specialized software such as SimaPro, GaBi, or pre-verified calculation tools to model cradle-to-gate and end-of-life scenarios (modules A1–A3 + C-D under EN 15804+A2). Ensure biogenic carbon flows are tracked separately—a critical requirement introduced in the A2 amendment.

Convert inventory data into the 19 mandatory impact indicators (including climate change fossil, biogenic, and land use change) plus 17 resource-use categories required for EPD Certification under A2. Identify environmental hotspots and improvement opportunities that inform both product development and transparent communication.

Combine LCA results, impact tables, and company information using the program operator’s standardized template (EN 15942 for construction products). Clear, well-structured documentation enhances usability and supports successful verification.

An accredited verifier reviews data quality, methodological assumptions, and PCR compliance before issuing a signed verification statement. The verification approach (individual, certification-body, or process-certified organization) must be clearly disclosed within the EPD Certification.

Submit the EPD, verification report, and supporting documentation to the program operator’s database. After fee payment and final review, your EPD Certification becomes publicly available through global platforms such as ECO Platform or environdec.com for its five-year validity period.

| Standard | Primary Scope | 2025 Relevance |

|---|---|---|

| ISO 14040/44 | LCA principles, requirements, and interpretation | Methodological foundation for every EPD Certification |

| ISO 14025 Type III | Program operator procedures and verifier independence | Ensures third-party credibility and market acceptance |

| EN 15804+A2 (Europe) | Core PCR for construction products | Mandatory since 2022; introduces 13 additional impact categories |

| ISO 21930 | Global standard for building materials | Essential for international markets; note alignment considerations with A2 |

Third-party verification transforms environmental claims into trusted market credentials. Independent verification provides:

Validated Experience – Verifiers confirm that data collection reflects actual manufacturing processes and real operational conditions rather than theoretical estimates.

Technical Expertise – Auditors with specialized credentials (such as LCACP certification) ensure compliance with ISO standards and PCR requirements.

Market Authority – Program operators like IBU, BRE, and EPD International maintain controlled databases that provide institutional credibility and market recognition.

Stakeholder Trust – Signed verification statements demonstrate impartial professional review, giving specifiers and procurement teams confidence in environmental claims.

Data availability limitations – Apply tiered secondary data approaches (maintaining under 10% by mass) where primary collection proves impractical, with full source disclosure for verification acceptance.

Complex end-of-life modeling – Leverage program operator templates and pre-verified calculation tools to streamline Module D calculations while ensuring accuracy.

Budget considerations – Process-certified organizations can self-declare multiple EPDs following initial system certification, significantly reducing ongoing third-party costs.

Leading manufacturers recognize that EPD Certification extends beyond compliance to create measurable business value. Organizations implementing systematic approaches to environmental declaration development report shorter development cycles, improved verifier relationships, and enhanced market positioning.

Modern EPD Certification processes integrate seamlessly with existing quality management systems, leveraging established data collection protocols and validation procedures. This integration approach reduces administrative burden while ensuring consistent, high-quality environmental declarations.

The evolving EPD Certification landscape requires careful attention to regional requirements and international harmonization efforts. European markets mandate EN 15804+A2 compliance, while global markets increasingly reference ISO 21930. Understanding these nuances ensures broad market acceptance and regulatory compliance.

Manufacturers serving multiple markets benefit from dual-standard approaches that satisfy both European A2 requirements and international ISO 21930 frameworks, though careful attention to methodological differences remains essential.

Successful EPD Certification programs embed quality assurance throughout the development process. This includes systematic data validation, regular methodology updates, and proactive communication with verification bodies. Organizations implementing robust quality frameworks report significantly reduced verification timelines and enhanced stakeholder confidence.

Continuous improvement approaches integrate EPD Certification development with broader sustainability initiatives, creating synergies between environmental reporting, product development, and market communication strategies.

The EPD Certification in Saudi Arabia landscape continues evolving with new impact categories, enhanced data requirements, and expanded application areas. Forward-thinking organizations develop flexible systems capable of adapting to changing requirements while maintaining operational efficiency.

Emerging trends include increased emphasis on supply chain transparency, enhanced end-of-life modeling, and integration with digital product passports. Positioning your EPD Certification program to address these developments ensures continued market relevance and competitive advantage.

EPD Certification in KSA and UAE has evolved from specialized sustainability reporting to essential market infrastructure. The seven-step development process—Scoping, Data Collection, Modeling, Interpretation, Document Drafting, Third-Party Verification, and Registration—provides a proven pathway to credible environmental declarations that satisfy regulatory requirements and market expectations.

Success requires systematic attention to data quality, methodological rigor, and stakeholder communication. Organizations implementing comprehensive EPD Certification strategies report improved market access, enhanced stakeholder trust, and strengthened competitive positioning. Begin your development process today, and your verified environmental declaration could be supporting project wins and market differentiation within months.

At Chiltern TMC, we have successfully delivered end-to-end EPD support recently for one of our recent projects for Yaqout Ceramic based in Kingdom Of Saudi Arabia and it has been officially published with company branding and verified impact data.

🔗 View Our Published EPD in the International EPD®

Published EPD Certification in Saudi Arabia Client Yaqout Ceramic EPD

This is a clear example of how we help clients in to secure EPD certification that meets international and regional standards.

Written by Ahamed Aasir, Sustainability Marketing Consultant for Chiltern TMC Consultant.

Last Updated: July 31, 2025

An Environmental Product Declaration (EPD) is a standardized, third-party verified document that quantifies the environmental impact of a product across its entire life cycle—from raw material extraction to disposal.

It’s based on:

Unlike marketing claims or green labels, EPD certification is data-driven and internationally recognized—making it especially valuable for companies in Dubai, UAE and Saudi Arabia that want to position themselves as credible suppliers in the green building sector.

Demand for EPD certification in Dubai, UAE and Saudi Arabia is rapidly growing, fueled by:

✅ Green Building Regulations

Projects following Estidama (Abu Dhabi), Dubai Green Building Code, and the Saudi Green Building Code are prioritizing EPD-certified materials for LEED, BREEAM, and other rating systems.

✅ CBAM & Export Compliance

The EU’s Carbon Border Adjustment Mechanism (CBAM) and other international sustainability requirements are prompting manufacturers in the GCC to publish EPDs to stay eligible for export.

✅ Vision 2030 & Net Zero Goals

With UAE targeting Net Zero by 2050 and Saudi Arabia by 2060, governments and large developers now require suppliers to disclose environmental impact transparently.

✅ Reputation & Procurement Advantage

Buyers, project developers, and investors are prioritizing vendors with verified sustainability data—making EPDs a key differentiator.

Businesses that will benefit from EPD certification in Dubai, UAE and Saudi Arabia include:

If your products are used in large infrastructure or green-certified buildings, EPDs can position you for long-term contracts and higher-value projects.

The certification process includes four main stages:

1. Life Cycle Assessment (LCA): – A cradle-to-gate or cradle-to-grave LCA quantifies your product’s environmental performance using tools like OpenLCA or SimaPro.

2. Choose an EPD Program Operator:- Recognized international programs include:

3. Third-Party Verification :- An independent expert validates your LCA, ensuring accuracy and conformance with Product Category Rules (PCRs).

4. Publication:- The final EPD is registered and made publicly accessible on the program operator’s website, ready to be used in bids and sustainability reports.

At Chiltern TMC, we’ve successfully delivered end-to-end EPD support. One of our recent projects — for Wangkang Ceramic — has been officially published with company branding and verified impact data.

🔗 View Our Published EPD: Wangkang Ceramic EPD – Huella Ambiental

This is a clear example of how we help clients in Dubai, UAE and Saudi Arabia secure EPD certification that meets international and regional standards.

🚧 Data Gaps – Local manufacturers often lack detailed product or process data.

✅ Solution: Chiltern helps bridge these gaps using a combination of on-site audits and trusted secondary datasets.

🚧 Technical Complexity – ISO standards and PCR navigation can be overwhelming.

✅ Solution: We handle everything from LCA modeling to verifier coordination.

🚧 Cost Concerns – SMEs worry about ROI.

✅ Solution: EPDs reduce tender rejections and improve export access—often paying for themselves in 6–12 months.

✔️ Win Public & Green Building Projects

Government and semi-government contracts increasingly require EPDs as part of sustainability scoring.

✔️ Boost Export Eligibility

Meet rising environmental requirements in Europe, US, and Australia.

✔️ Support Net Zero Goals

Demonstrate alignment with UAE’s Net Zero 2050 and Saudi Arabia’s Vision 2030–2060.

✔️ Enhance Trust & Transparency

Stand out in procurement with verified impact data, not just claims.

We’ve supported clients across the GCC in:

📩 Contact us at info@chilterntmc.com to get started.

EPD certification in Dubai, UAE and Saudi Arabia is more than a compliance requirement — it’s a competitive advantage. From local green building credits to global export acceptance, EPDs help your business stay relevant, transparent, and future-ready.

If you’re ready to publish your first EPD or scale your sustainability credentials, Chiltern TMC is here to support your journey from start to finish.

Many companies come to us with the same frustration.

They’ve done everything by the book:

✅ Signed up with EcoVadis

✅ Submitted the questionnaire on time

✅ Uploaded all required documentation

Then they wait…

Only to receive a score that feels like a letdown.

A Bronze medal. Or even just the Basic badge.

No supplier recognition.

No competitive edge.

No celebration.

At first, it feels confusing—especially when:

Your compliance team is experienced

Your documentation is thorough

Your commitment to sustainability is 100% genuine

So, what went wrong?

EcoVadis doesn’t just reward what you submit.

It rewards how well your sustainability practices are embedded in your business.

That means:

Systems matter

Structure matters

Strategy matters

In our experience, this is where most companies fall short:

❌ Policies uploaded, but not tied to measurable KPIs

❌ Training materials exist, but no proof of implementation

❌ No formal risk assessment process in place

❌ Weak or missing supply chain due diligence

❌ Lack of external certifications or third-party validation

These aren’t just missing boxes—they’re missed opportunities to prove credibility and maturity in your sustainability management.

Your score improves. And with that, new doors open:

✅ Bronze becomes Silver

✅ Silver becomes Gold

✅ You qualify for preferred supplier programs

✅ Clients and partners start to trust your sustainability claims

You don’t need to redo everything from scratch.

You just need a partner who understands:

How EcoVadis evaluates maturity

What the algorithm is really looking for

And how to align your internal systems to match

That’s what we do at Chiltern TMC.

We’ve helped companies across industries move up the EcoVadis ladder—without unnecessary delays or wasted resources.

So if you’re done settling for underwhelming scores and ready to finally earn the rating your efforts deserve—

Let’s talk.

📩 Reach out via email or live chat to contact our ecovadis rating improvement consultants

Or…

You could submit another report that gets lost in the pile.

Your call.

ESG Consulting is no longer just a trend—it’s a fundamental shift in how businesses operate. Whether you’re a small enterprise or a multinational corporation, integrating Environmental, Social, and Governance (ESG) principles into your business strategy isn’t just about doing good; it’s about staying competitive, attracting investors, and mitigating risks.

But let’s be honest—keeping up with ESG regulations, reporting standards, and investor expectations can be overwhelming. That’s where ESG consulting comes in. ESG consultants help businesses navigate the complexities of sustainability, ensuring compliance while unlocking new growth opportunities.

In this guide, we’ll dive deep into what ESG consulting is, why it matters, and how it can transform your business. Whether you’re just starting or looking to refine your ESG strategy, this guide will give you the insights you need to make informed decisions.

At its core, ESG consulting helps businesses integrate sustainable practices into their operations. It involves assessing environmental impact, corporate governance, and social responsibility to align with regulations and stakeholder expectations.

✔️ Evaluate sustainability risks and opportunities

✔️ Develop ESG frameworks and policies

✔️ Ensure compliance with local and global regulations

✔️ Improve ESG ratings for investor confidence

✔️ Guide businesses on responsible corporate governance

In short, ESG consultants don’t just help companies stay compliant—they help them turn sustainability into a competitive advantage.

ESG isn’t just about ethics; it’s about business survival. Here’s why companies are investing in ESG consulting now more than ever:

Risk Management & Future-Proofing → ESG consulting helps businesses identify and mitigate long-term risks, from climate change to supply chain vulnerabilities.

Sustainability isn’t just a nice-to-have—it’s a business necessity. Companies with solid ESG practices earn customer trust, attract better partnerships, and stand out in the market.

Many businesses assume that sustainability initiatives are costly. However, studies show that companies with strong ESG strategies often outperform their competitors financially due to operational efficiency and reduced risks.

Laws like the EU CSRD, SEC Climate Disclosure Rules, and GRI Standards are becoming more stringent. ESG consultants help businesses stay ahead of these evolving regulations, avoiding penalties and reputational damage.

Private equity firms, venture capitalists, and institutional investors are prioritizing ESG factors. A well-executed ESG strategy improves your chances of securing funding.

People want to work for companies that align with their values. A strong ESG strategy improves workplace culture, employee satisfaction, and retention rates.

Benefits of ESG Consulting Services

Stronger Brand Reputation

Sustainability isn’t just a nice-to-have—it’s a business necessity. Companies with solid ESG practices earn customer trust, attract better partnerships, and stand out in the market.

2. Improved Financial Performance

Many businesses assume that sustainability initiatives are costly. However, studies show that companies with strong ESG strategies often outperform their competitors financially due to operational efficiency and reduced risks.

3. Compliance with Global Regulations

Laws like the EU CSRD, SEC Climate Disclosure Rules, and GRI Standards are becoming more stringent. ESG consultants help businesses stay ahead of these evolving regulations, avoiding penalties and reputational damage.

4. Attracting Investors and Business Partnerships

Private equity firms, venture capitalists, and institutional investors are prioritizing ESG factors. A well-executed ESG strategy improves your chances of securing funding.

5. Employee Engagement and Talent Retention

People want to work for companies that align with their values. A strong ESG strategy improves workplace culture, employee satisfaction, and retention rates.

How ESG Consultants Help Businesses Stay Compliant

Regulations surrounding ESG are evolving rapidly, and keeping up can be challenging. ESG consultants play a crucial role in ensuring compliance with frameworks such as:

Global Reporting Initiative (GRI) – Standardized ESG reporting framework

Sustainability Accounting Standards Board (SASB) – Industry-specific ESG disclosures

Task Force on Climate-related Financial Disclosures (TCFD) – Climate risk reporting

EU Corporate Sustainability Reporting Directive (CSRD) – Mandatory ESG disclosures for European businesses

United Nations Sustainable Development Goals (SDGs) – Global sustainability targets for businesses

Steps ESG Consultants Take to Ensure Compliance:

✔ Conducting ESG risk assessments

✔ Aligning corporate strategies with international sustainability goals

✔ Developing ESG training programs for employees and leadership teams

✔ Advising on carbon reduction and responsible supply chain management

Key ESG Challenges & How Consultants Address Them

Despite its benefits, implementing ESG initiatives comes with challenges. Here’s how ESG consulting helps businesses overcome these obstacles:

Challenge 1: Unclear ESG Regulations & Reporting Standards

Solution: ESG consultants provide clarity on different frameworks (GRI, SASB, TCFD) and tailor strategies to meet regulatory requirements.

Challenge 2: Measuring ESG Impact & ROI

Solution: Consultants develop key performance indicators (KPIs) and reporting tools to measure and communicate ESG progress effectively.

Challenge 3: Resistance to Change Within Organizations

Solution: ESG consultants conduct awareness programs and training sessions to ensure leadership and employees embrace sustainability goals.

Challenge 4: Greenwashing Accusations

Solution: Consultants ensure companies back up their ESG claims with real data, preventing reputational damage from misleading sustainability claims.

How to Choose the Right ESG Consulting Firm

Not all ESG consultants are created equal. Here’s what to consider when selecting an ESG consulting partner:

✔ Industry Expertise – Do they have experience in your sector (e.g., finance, manufacturing, tech)?

✔ Regulatory Knowledge – Do they understand global ESG compliance laws?

✔ Proven Track Record – Can they provide case studies and success stories?

✔ Custom Solutions – Do they offer tailored ESG strategies rather than one-size-fits-all approaches?

✔ Technology & Data Analytics Capabilities – Can they implement digital tools for ESG tracking and reporting?

ESG Trends in 2025 & Beyond

The ESG landscape is rapidly evolving. Here are some trends shaping the future of ESG consulting:

🌍 Mandatory ESG Reporting Will Become Standard → More governments will enforce stricter disclosure laws.

📊 AI & Big Data in ESG → Companies will use advanced analytics to track and report ESG performance.

🔄 Circular Economy Initiatives → Businesses will focus on reducing waste and improving resource efficiency.

💡 Climate Risk Management → Companies will prioritize resilience planning for climate-related risks.

ESG consulting will play a crucial role in helping businesses adapt to these trends and stay competitive in a sustainability-driven world.Future-Proof Your Business with ESG Consulting

Sustainability isn’t just a corporate responsibility—it’s a strategic advantage. Businesses that integrate ESG principles into their operations not only meet compliance requirements but also unlock new growth opportunities, attract investors, and build lasting brand value.

However, ESG isn’t a one-size-fits-all approach. Each company has unique challenges and goals, which is why ESG consulting is essential. A good ESG consultant helps businesses navigate the complexities of regulations, develop data-driven strategies, and ensure long-term success.

If your business hasn’t yet invested in ESG consulting, now is the time to start. Because in today’s business world, those who embrace sustainability don’t just survive—they thrive.

Written by Ahamed Aasir, Sustainability Marketing Consultant for Chiltern TMC Consultant.

Sustainability and corporate responsibility are no longer optional. Companies must comply with Environmental, Social, and Governance (ESG) standards to build trust, attract investors, and meet regulatory requirements. However, one major challenge remains: how to efficiently track, analyze, and report ESG data.

Traditionally, businesses have relied on manual ESG reporting methods, but with the advent of ESG reporting software, companies now have a powerful alternative. The question is: which one is better? In this blog, we will compare ESG reporting software with manual reporting to help you make an informed decision.

ESG reporting is the process of disclosing an organization’s impact on environmental, social, and governance factors. This includes carbon emissions, energy usage, labor policies, diversity, ethical governance, and more. Accurate ESG reporting is essential for regulatory compliance, stakeholder transparency, and sustainable business growth.

Manual ESG reporting involves collecting and processing ESG data using spreadsheets, documents, and emails. Companies manually enter data, analyze it, and generate reports based on internal policies or external regulatory requirements.

ESG reporting software is an automated solution that helps businesses collect, analyze, and generate ESG reports efficiently. These tools integrate with data sources, automate calculations, and provide real-time insights into ESG performance.

Feature | ESG Reporting Software | Manual ESG Reporting |

Data Accuracy | High (automated error-checking) | Low (prone to human errors) |

Time Efficiency | Fast (automated processes) | Slow (manual data collection) |

Scalability | High (suitable for large enterprises) | Low (challenging for complex reporting) |

Compliance | Easily aligned with global standards | Requires manual effort to ensure compliance |

Real-Time Monitoring | Yes | No |

Cost | Higher upfront cost but cost-effective long term | Lower initial cost but expensive in terms of time and errors |

The choice between ESG reporting software and manual reporting depends on your company’s needs:

While manual ESG reporting may seem cost-effective initially, it becomes inefficient and error-prone as ESG data complexity increases. ESG reporting software offers automation, accuracy, and compliance benefits that make it the preferred choice for modern businesses.

For organizations looking to enhance their ESG reporting capabilities, investing in ESG software is a strategic move that ensures sustainability, compliance, and data-driven decision-making.

Explore leading ESG reporting software solutions today and transform how you manage sustainability data. The future of ESG reporting is digital, and now is the time to make the switch!

Learn the key advantages of pursuing FSC certification Dubai for wood, paper and forestry product companies operating in the UAE.